This guide will provide a roadmap to transforming your AR management, moving from a reactive, stressful chore to a proactive, strategic money model.

We will explore:

-

- What AR is, and why it’s so critical,

-

- How to benchmark your performance with hard data,

-

- Diagnose the common roadblocks that hinder cash flow,

-

- And implement a proven strategy to get paid more often, in less time.

What is Dental Accounts Receivable (AR)?

At its core, Accounts Receivable (AR) is the total of all outstanding invoices or money owed to your practice by both patients and insurance companies for treatments that have been completed but not yet paid for.

Total AR = Σ (Insurance Invoices) + Σ (Patient Invoices)

While it may seem like a simple back-office accounting function, the health of your AR management directly affects every aspect of your practice. Effective management is not just about chasing down late payments; it’s a foundational pillar of a thriving dental business.

Why Accounts Receivable Matters More Than You Think

AR isn’t just an accounting task; it is the money model of your entire dental practice. It’s the engine that converts your hard work into the cash required to run, grow, and thrive.

Simply: proper AR management brings cash forward that you can use TODAY in your practice.

By shifting your focus to solving AR Management, you create a domino effect that solves your biggest challenges in three key areas:

1. Profitability & Cash Flow

A practice can be highly productive but still cash-poor. The problem isn’t a lack of work; it’s a delay in turning that work into usable cash.

Solving the AR model closes the gap between production and payment. It creates a predictable system that ensures the money you’ve earned reliably arrives in your bank account, providing the consistent cash flow needed to cover payroll, supplies, and daily operating expenses without stress or uncertainty.

2. Growth

The old adage is that “you must spend money to make money”. This is true: marketing requires investment. But instead of funding this investment with your own capital, a solved AR model provides that investment inherently.

For example; a practice that brings forward $1,000 from a single procedure with efficient AR management can then invest that $1,000 to acquire 2 new patients. Each of those patients can then finance the acquisition of 2 more new patients (again with proper AR management).

This creates a powerful cycle of growth, where your cash flow continuously funds your expansion. In this model, cash is no longer the limiting factor holding back your practice.

3. Patient Experience

The financial interaction is one of the last and most memorable parts of the patient journey. A confusing, high-friction billing process that lasts months on end can erode an excellent clinical experience, leading to frustration, negative reviews, and patient loss.

Solving AR Management means making payments clear, convenient, and respectful. This transforms a potential point of conflict into a final, positive touchpoint that reinforces trust and professionalism, ensuring patients leave feeling valued in every aspect of their care.

From Reactive to Proactive:

A 5-Step Strategy to Master Your AR

Transforming your accounts receivable requires a strategic, systematic approach that addresses the root causes of payment delays. Moving from a reactive to a proactive model involves implementing clear policies and streamlined workflows at every stage of the patient’s financial journey.

Step 1: Build a Clear Financial Foundation

The cornerstone of any successful collections system is a clear, comprehensive, and consistently enforced written financial policy. This document removes ambiguity for both your team and your patients.

- Action: Create a formal financial policy and have every patient review and sign it as part of their initial paperwork.

- Details: The policy should explicitly detail how your practice handles key financial matters. This includes when payment is due (e.g., at the time of service), the payment methods you accept, how insurance claims are processed, and your policies on any potential fees for broken appointments or late payments. It should also outline any available financing options. This document sets clear expectations from the very beginning of the relationship.

Step 2: Perfect the Pre-Treatment Workflow

The most effective way to manage AR is to do the majority of the financial work before any clinical work begins. This front-end effort prevents most back-end problems.

- Action: Implement a strict pre-treatment financial clearance process for every patient.

- Details:

-

- Verify Insurance Benefits: Before the day of the appointment, your team must verify every patient’s insurance eligibility, benefits, deductibles, and plan limitations. This proactive step prevents denials due to lapsed coverage or other eligibility issues.

-

- Provide Transparent Estimates: Present the patient with the full fee for the proposed treatment, the estimated insurance portion, and their estimated out-of-pocket cost. It is critical to verbally and in writing emphasize that the insurance coverage is only an estimate, and the patient is ultimately responsible for the full balance. For patients who want an exact copayment amount, offer to submit a pre-treatment estimate to their insurer.

-

- Collect at Time of Service: The single most effective way to reduce patient AR is to collect their estimated portion on the day of treatment. This should be the standard procedure in your practice, framed as a normal part of the transaction.

Step 3: Streamline Your Claims and Appeals Process

Treating insurance claims with precision rather than as an afterthought is key to accelerating payments from payers.

- Action: Develop a standardized operating procedure (SOP) for claims submission and management.

- Details:

-

- Submit Claims Within 24 Hours: File claims immediately after treatment, while all the necessary information is fresh and easily accessible.

-

- “Over-explain” with Documentation: Proactively combat denials by including all relevant supporting documentation with the initial claim. Attach necessary X-rays, intraoral photos, clinical notes, and detailed narratives to prove medical and dental necessity.

-

- Invest in Team Education: Denials are often the result of a knowledge gap. Prioritize regular training for your administrative team on the latest CDT/DPC coding updates, billing regulations, and best practices for claim submission to minimize costly errors.

Step 4: Make Payments Painless for Patients

Removing friction from the payment process encourages patients to settle their balances quickly and without hassle.

- Action: Offer a variety of modern, convenient payment options.

- Details: Cater to modern consumer expectations by offering multiple ways to pay, including online payments, text-to-pay links, and credit/debit card payments. For larger treatment plans, consider offering in-house and/or third-party payment plans.

Step 5: Systematize Follow-Up

For the balances that do become overdue, a persistent, professional, and systematic follow-up process is essential.

- Action: Implement a consistent, documented cadence for following up on all aging accounts.

- Details:

-

- Work Your AR list Weekly: Designate a specific block of time each week for a dedicated team member to review your accounts receivable. This time should be used to follow up on all accounts over 30 days past due, prioritizing the oldest and largest balances first.

-

- Establish a Follow-Up Timeline: Document a clear escalation process. For example, an email is sent at 30 days, a personal phone call is made at 45 days, and a formal collection letter is sent at 60 days. Consistency is the key to demonstrating that you are serious about collections.

Transforming Your AR with Smilepass

While the metrics and five-step strategy we’ve outlined provide a framework for success, executing it manually is a lot of work. It can easily become a full-time job for one or more team members, pulling them away from patient-facing roles and reintroducing the very administrative bottleneck you are trying to solve.

The key to implementing this strategy efficiently, consistently, and at scale lies in leveraging modern technology and automation.

This is precisely where Smilepass transforms the patient AR management process. Smilepass is a platform designed specifically to automate the most time-consuming, error-prone, and critical components of collecting the patient portion of your receivables. It takes all of the principles of a proactive AR strategy and puts them on autopilot.

| Core AR Task | The Traditional (Manual) Method | The Smilepass (Automated) Advantage |

| KPI Tracking & Analytics | Manual data entry into your PMS, spreadsheets, or generating raw reports. | Real-time dashboard that tracks key metrics (like Collection Ratio, A/R Breakdowns & Aging) instantly. |

| Automated Insurance Verification | Manual calling of insurance companies or navigation of slow web portals for each patient. | Automatic verification of patient eligibility and benefits in real-time before the appointment with 98% accuracy. |

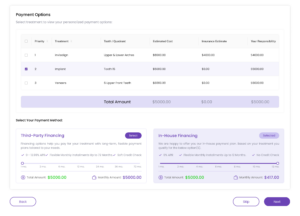

| Payment Plans | In-house patient financing with default risks attached to the clinic. | Customizable payment plans integrated directly into your digital treatment plan. Choose to manage in-house and/or third-party plans with ease. |

| Payment Reminders | Manual texts or mailing paper statements with the need for uncomfortable follow-up phone calls. | Automated, friendly email and text reminders sent at optimal intervals based on the invoice date. |

| Collections | Relies on patients remembering to pay or calling the office during business hours. | Every reminder includes a built-in, one-click payment link. |

By automating these core functions, Smilepass delivers a powerful ROI that goes beyond just collecting more money. The benefits align with the goals of a modern, patient-centric practice:

-

- Save Administrative Hours: Free your front desk team from the thankless tasks of chasing payments, allowing them to focus on high-value activities like patient care, scheduling productive appointments, and growing the practice.

-

- Boost Your Collection Rate & Cash Flow: Get paid faster, reduce the number of accounts that age into the 90+ day danger zone, and minimize the need for costly write-offs.

-

- Enhance the Patient Experience: Provide a modern, convenient, and respectful payment process that eliminates friction and builds trust. A positive financial experience reinforces the positive clinical experience, leading to greater patient loyalty and retention.

Take Control of Your Cash Flow Today

Effective Accounts Receivable management is not an insurmountable challenge, nor is it a secondary administrative task. It is a core business function that is central to the financial health, profitability, and long-term success and growth of your dental practice.

By understanding your key metrics, implementing proactive systems, and, most importantly, leveraging the power of automation, any practice can transform its financial outlook.

Stop letting aging receivables drain your practice’s profitability. See how Smilepass can automate your collections and boost your revenue. Schedule a free demo today.