KPIs act as a scorecard, providing an objective look at your performance and highlighting exactly where improvements are needed. By regularly monitoring these numbers, you can diagnose problems early, set realistic goals, and measure the success of your improvement strategies.

The 3 Metrics Every Practice Must Track in AR Management

The following three metrics are the most critical for assessing the health of your practice’s AR system.

|

Key Performance Indicator |

What It Measures |

Industry Benchmark/Goal |

|

Accounts Receivable (A/R) Ratio |

The efficiency of your collections relative to production. Calculated as: (Total AR / Average Monthly Production) |

Ratio = 1.0 (Total AR should be equal to or less than one month’s production) 2 |

|

Collection Ratio |

The percentage of earned fees that you successfully collect. Calculated as: (Gross Collection / Gross Production) |

98% 2 |

|

A/R Over 90 Days |

The portion of your receivables that is highly at risk of becoming bad debt. |

< 5% of total AR 7 |

Accounts Receivable (A/R) Ratio

The A/R Ratio is a top-level indicator of your practice’s overall collection efficiency. It tells you how many months of production are currently tied up in unpaid invoices. The industry-standard goal is a ratio of 1.0 or less, meaning your total outstanding AR should not exceed your average production for a single month.6

A ratio significantly above 1.0 is a red flag. It indicates that your practice is effectively acting as a bank, extending a large line of credit to patients and insurance companies, which is a risky position that can severely restrict your cash flow.

Collection Ratio

This metric measures how much of the money you’ve earned (gross production value) you are actually collecting (gross collection). While a ratio between 95% and 99% is often considered good, top-performing practices consistently aim for 98% or higher.

The impact of this metric on profitability is immense. For a practice with $1,212,500 in annual gross production value, the difference between a 95% collection rate ($1,151,875) and a 98% collection rate ($1,188,250) is over $36,000 in pure profit—money that goes directly to the bottom line without any additional production costs.

A/R Aging Report

Not all accounts receivable are created equal. The A/R Aging Report is a critical tool that breaks down your total AR into time-based categories (e.g., 0-30 days, 31-60 days, 61-90 days, and 90+ days).

This report is vital because the probability of collecting a payment drops dramatically as an account ages. Balances that are over 90 days past due are at extremely high risk of becoming uncollectible bad debt. Industry best practices suggest that no more than 5% of your total AR should be in the 90+ day category.

If a large percentage of your AR is aging past 60 or 90 days, it points to significant issues in your follow-up and collections processes that require immediate attention.

How Smilepass Makes Managing AR Easy

Understanding your key AR performance metrics is the first step in managing your Accounts Receivable (AR) effectively. Smilepass makes this easy by integrating your practice’s most important financial KPIs directly into our intuitive dashboard.

By directly integrating into your PMS, Smilepass can display each key metric related to your AR Management, instantly.

In addition to providing analytics and KPI tracking, Smilepass also automates the manual work required to improve these metrics:

|

Core AR Task |

The Smilepass AR Advantage |

|

Automated Insurance Verification |

Automated verification of patient eligibility and benefits in real-time before the appointment with 98% accuracy. |

|

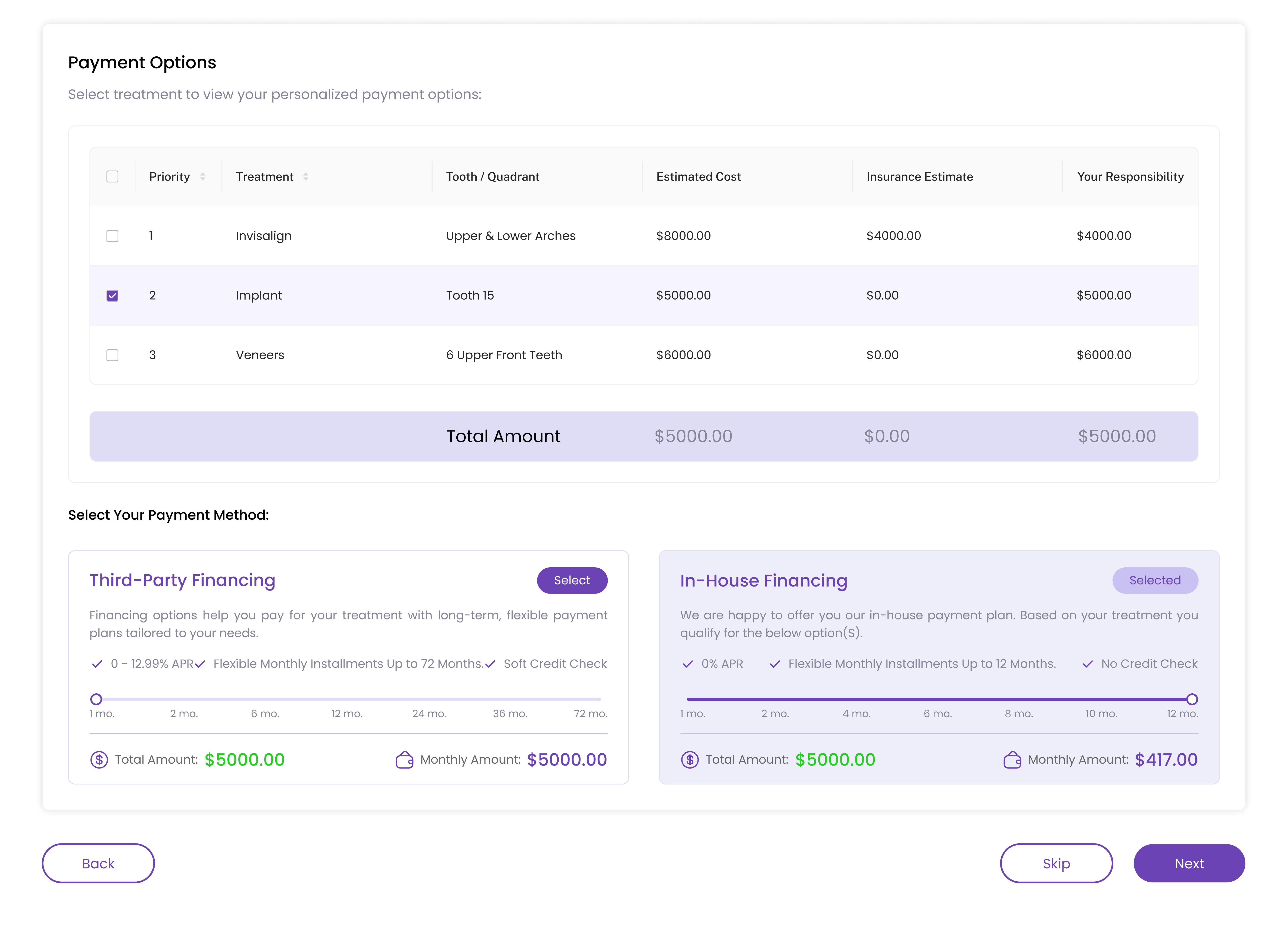

Integrated Payment Plans |

Customizable payment plans integrated directly into your digital treatment plan. Choose to manage in-house or 3rd-party plans with ease. |

|

Payment Reminders |

Automated, friendly email and text reminders sent at optimal intervals based on the invoice date. |

|

Collections |

Every reminder includes a built-in, one-click payment link. |

By automating these core functions, Smilepass delivers a powerful ROI that goes beyond just collecting more money. The benefits align with the goals of a modern, patient-centric practice:

- Save Administrative Hours: Free your front desk team from the thankless tasks of chasing payments, allowing them to focus on high-value activities like patient care, scheduling productive appointments, and growing the practice.

- Boost Your Collection Rate & Cash Flow: Get paid faster, reduce the number of accounts that age into the 90+ day danger zone, and minimize the need for costly write-offs.

- Enhance the Patient Experience: Provide a modern, convenient, and respectful payment process that eliminates friction and builds trust. A positive financial experience reinforces the positive clinical experience, leading to greater patient loyalty and retention.16

Take Control of Your Cash Flow Today

Effective Accounts Receivable management is not an insurmountable challenge, nor is it a secondary administrative task. It is a core business function that is central to the financial health, profitability, and long-term success and growth of your dental practice.

By understanding your key metrics, implementing proactive systems, and, most importantly, leveraging the power of automation, any practice can transform its financial outlook.

Stop letting aging receivables drain your practice’s profitability. See how Smilepass can automate your collections and boost your revenue. Schedule a free demo today.