The Insurance Gauntlet: Claim Delays and Denials

A significant portion of aging AR stems from issues with insurance claims. These problems are often caused by simple, preventable errors that bring the payment process to a halt.

- Incorrect or Incomplete Information: Simple data entry mistakes, such as a misspelled name, an incorrect date of birth, or the wrong policy number, are a frequent cause of immediate claim rejection.

- Coding Errors: The landscape of CDT/DPC codes is complex and subject to annual changes. Using an outdated or incorrect code for a procedure is a guaranteed way to get a claim denied.

- Lack of Supporting Documentation: Insurance companies often require proof of medical and dental necessity for certain procedures. Failing to proactively attach the required supporting documents—such as X-rays, intraoral photos, clinical notes, or a detailed narrative—can lead to delays and denials.

- Eligibility Issues: One of the most common yet avoidable errors is failing to verify a patient’s insurance eligibility before treatment is rendered. If a patient’s coverage has lapsed or changed, any claim submitted will be denied, leaving the practice to chase the full amount from a potentially surprised patient.

Patient Dental Payments: Confusion and Procrastination

Collecting the patient portion of the bill presents its own unique set of challenges, often rooted in communication failures and a lack of convenience.

- “Sticker Shock” and Financial Surprises: The most difficult patient to collect from is one who is surprised by their bill. When financial responsibilities are not discussed clearly and transparently before treatment, patients may receive a bill they weren’t expecting and are unprepared to pay, leading to disputes and delays.

- Insurance Confusion: Most patients do not have a deep understanding of their own dental insurance plans, including deductibles, co-pays, and annual maximums. If the practice presents an insurance payment as a guarantee rather than an estimate, the patient may feel misled when the final bill is higher than anticipated, eroding trust and their willingness to pay promptly.

- Payment Friction: In today’s digital world, convenience is key. If a patient’s only options are to mail a check or call the office during limited business hours, payment is easily procrastinated. Outdated methods like paper statements are often lost, ignored, or simply add a layer of effort that causes delays.

The Administrative Bottleneck: The High Cost of Manual Labour

Even a team with the best intentions can struggle to manage AR effectively if they are bogged down by manual, inefficient processes. Administrative burden is a major hidden cost of poor AR management.

- Severe Time Constraints: Manually creating and mailing statements, making follow-up calls, and tracking down unpaid claims is time-consuming. Every hour your staff spends on these tasks is an hour they are not spending on patient-facing, revenue-generating activities like scheduling treatment or providing excellent customer service.

- Lack of a System: Without standardized and documented workflows (Standard Operating Procedures – SOPs), AR management becomes chaotic and inconsistent. This problem is magnified by staff turnover, as there is no formal process for new team members to follow, leading to repeated errors.

- Inaccurate Reporting: Manual processes, inconsistent write-off procedures, and unposted payments can lead to cluttered and untrustworthy AR reports. When you can’t trust your data, it becomes impossible to accurately forecast revenue or make sound financial decisions for the practice.

These individual roadblocks do not exist in isolation. They feed into each other, creating a destructive downward spiral.

For instance, a simple mistake in verifying insurance upfront leads to a claim denial. This denial increases the manual workload on the front desk team, who now have to investigate and appeal the claim. This added burden leaves them with less time for proactive tasks, like providing clear financial estimates to other patients. This, in turn, leads to more patient billing confusion and further payment delays.

This cycle directly results in the three outcomes that can cripple a practice: delayed cash flow, permanently lost revenue, and a damaged patient experience. Breaking this cycle requires a fundamental shift from reactive problem-solving to a proactive, system-based strategy.

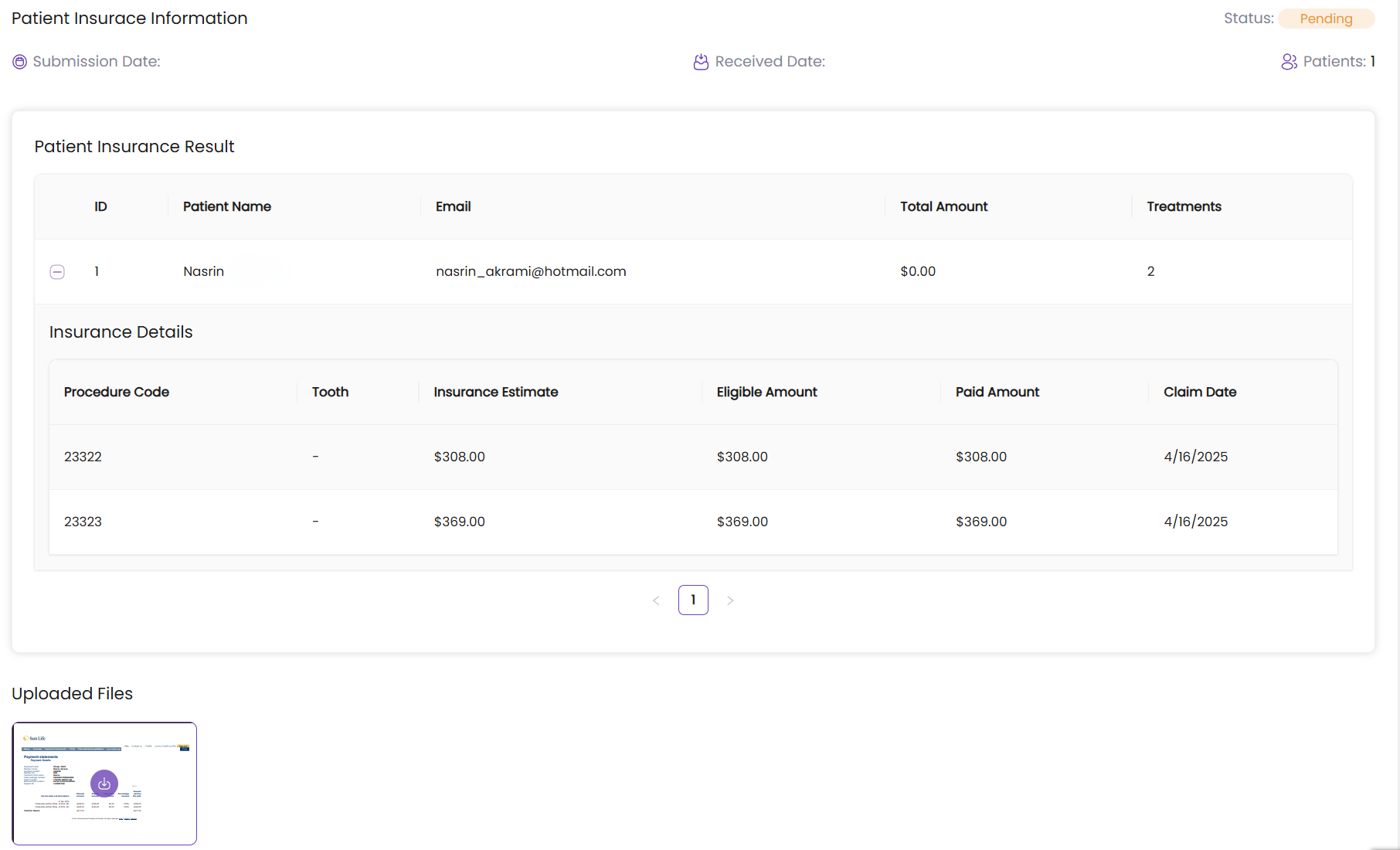

Automated Insurance Verification

Instantly verify patient eligibility and benefits in real-time with 98% accuracy. This prevents claim rejections and allows you to provide precise, upfront cost estimates, saving your team valuable time.

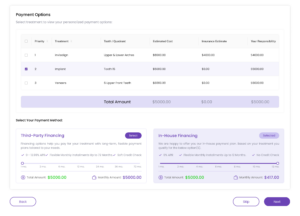

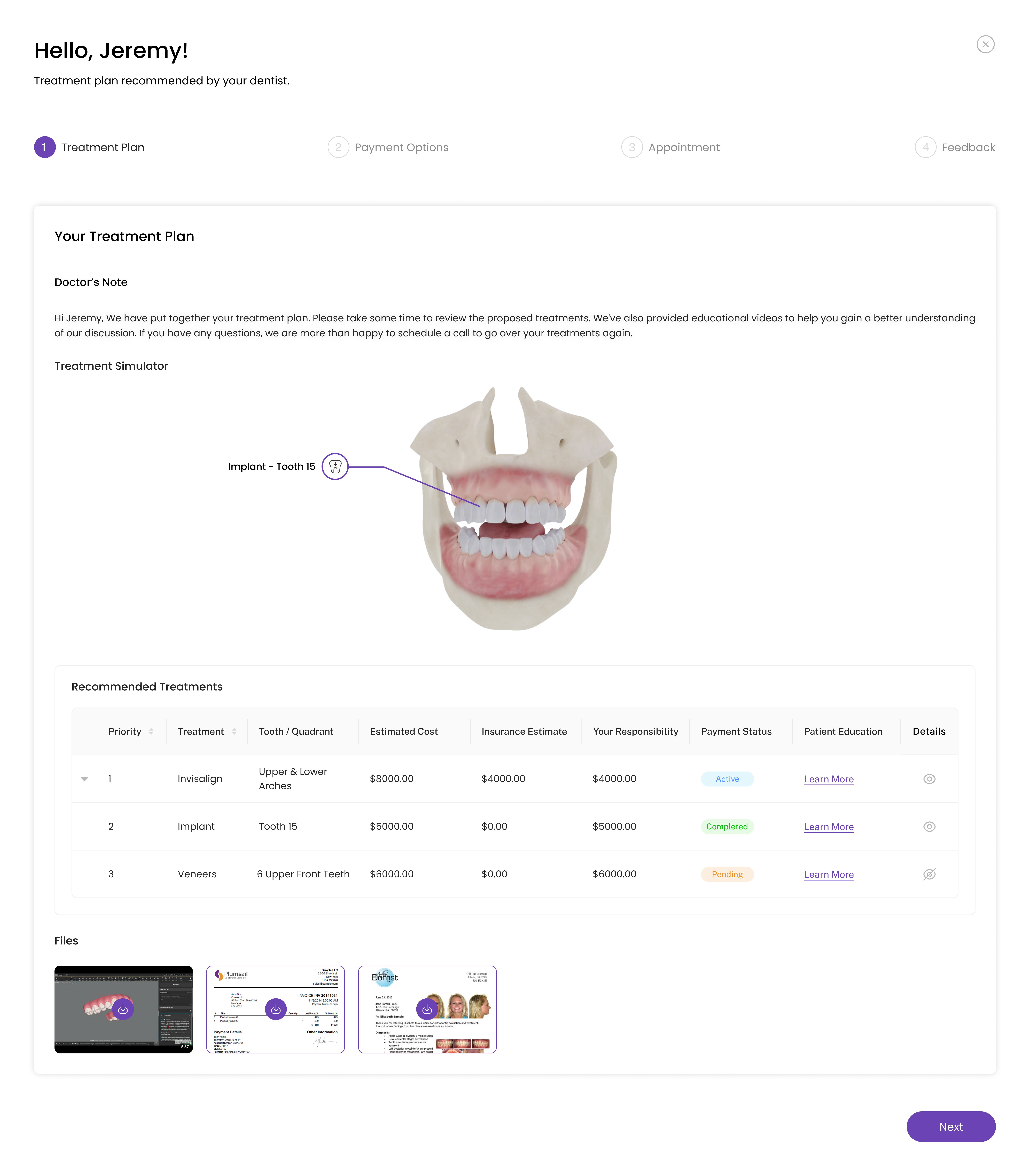

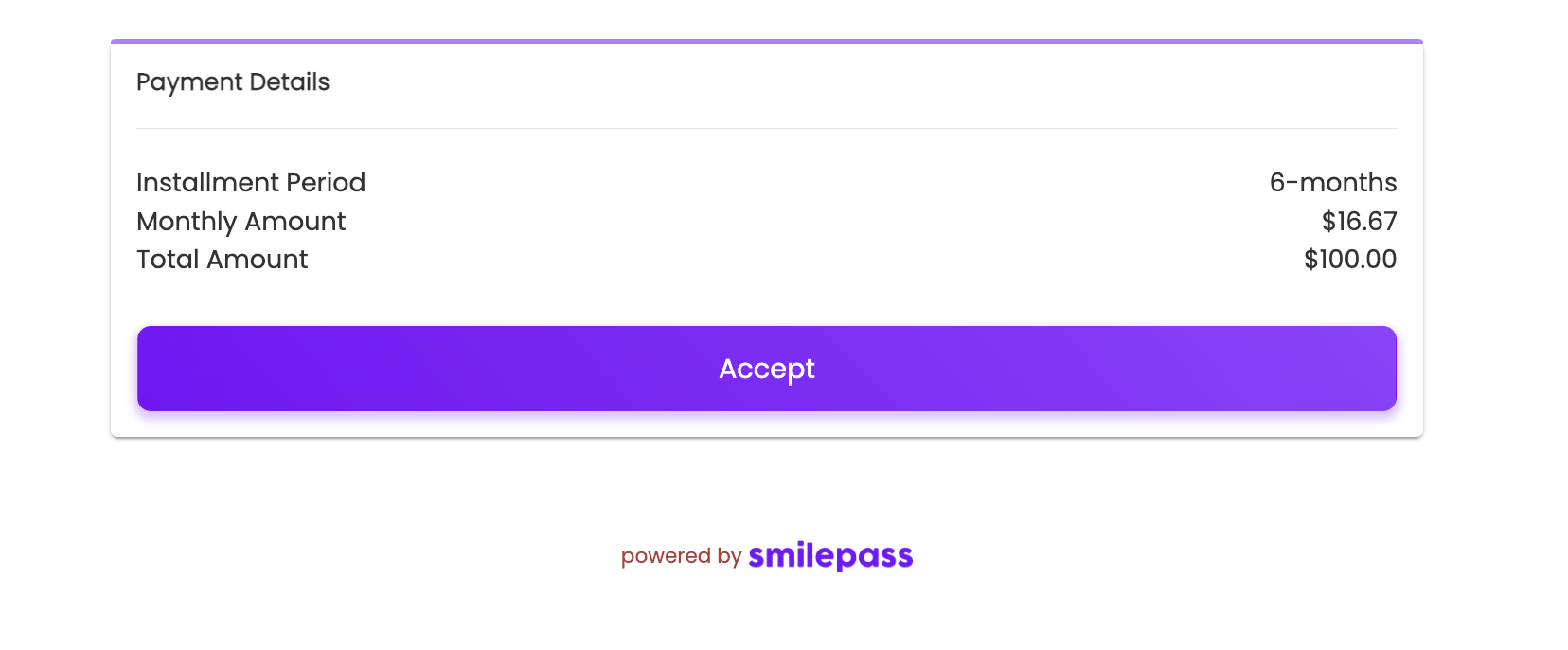

Integrated Payment Plans

Make treatment more affordable and increase case acceptance with flexible payment plans integrated directly into your digital treatment plan. Manage in-house or third-party financing options seamlessly from one dashboard to remove financial barriers for patients.

Payment Reminders

Ensure timely payments with automated, friendly email and text reminders sent at optimal intervals. This proactive approach improves collections while maintaining a positive relationship with your patients.

Collections

Get paid faster by making it easy for patients to pay. Every Treatment Plan and reminder includes a one-click payment link, simplifying the process for them and accelerating your revenue cycle.

And in addition to making AR management easier, Smilepass also hosts an intuitive dashboard that is directly integrated with your PMS:

This helps you understand your key AR performance metrics and monitor your progress with Smilepass.

Take Control of Your Cash Flow Today

Effective Accounts Receivable management is not an insurmountable challenge, nor is it a secondary administrative task. It is a core business function that is central to the financial health, profitability, and long-term success and growth of your dental practice.

By understanding your key metrics, implementing proactive systems, and, most importantly, leveraging the power of automation, any practice can transform its financial outlook.

Stop letting aging receivables drain your practice’s profitability. See how Smilepass can automate your collections and boost your revenue. Schedule a free demo today.